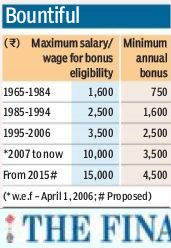

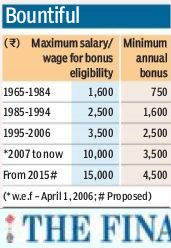

Bonus: Modi government to raise the salary threshold from Rs.10,000 to 15,000, ceiling limit from Rs. 3500 to 4500

An

estimate is two-thirds of the 6 crore organised sector workforce in the

country are eligible for the mandatory bonus given their salary levels.

Analysts, however, say that actual number of beneficiaries could be

less as many units practically circumvent the norm.Under Section 10 of Payments of Bonus Act, “every employer (as

defined in the Act) shall be bound to pay to every employee in respect

of every accounting year, a minimum bonus which shall be 8.33% of the

salary or wage earned by the employee during the accounting year”. All

factories and establishments employing 20 or more persons are expected

to pay the bonus compulsorily, provided the worker has worked in the

establishment for at least 30 days. Employees in Life Insurance

Corporation, seamen, dock workers and university employees are outside

the Act’s ambit.

An

estimate is two-thirds of the 6 crore organised sector workforce in the

country are eligible for the mandatory bonus given their salary levels.

Analysts, however, say that actual number of beneficiaries could be

less as many units practically circumvent the norm.Under Section 10 of Payments of Bonus Act, “every employer (as

defined in the Act) shall be bound to pay to every employee in respect

of every accounting year, a minimum bonus which shall be 8.33% of the

salary or wage earned by the employee during the accounting year”. All

factories and establishments employing 20 or more persons are expected

to pay the bonus compulsorily, provided the worker has worked in the

establishment for at least 30 days. Employees in Life Insurance

Corporation, seamen, dock workers and university employees are outside

the Act’s ambit.

In bonus to workers, cap on salary set to be raised: Financial Express News

Several lakhs of workers in the organised sector will benefit as the

Narendra Modi government is set to raise the salary threshold for

mandatory bonus for workers from Rs 10,000 a month at present to Rs

15,000 and the minimum bounty from an annual Rs 3,500 now to Rs 4,500.

The proposal, agreed to by employers’ associations at a recent meeting

of an inter-ministerial group, would require Parliament’s approval as

the Payments of Bonus Act, 1965, requires to be amended for this

purpose.

While the minimum bonus is a legal liability on the firms concerned,

whether or not they make a profits, these firms are also required to pay

the workers a higher bonus if their “allocable surplus” exceeds the

amount payable as minimum bonus, subject to a cap (20%) of the salaries.

If the new proposal takes affect, the maximum bonus payable by

profit-making ventures would be close to Rs 11,000 as against Rs 8,400

now.

The

salary ceiling for mandatory bonus eligibility was last fixed in 2007

and made effective retrospectively from April 1, 2006. While industry

associations demanded exempting sick units from the requirement of

paying bonus, trade unions have pitched for removal of the ceilings as

“profits are not capped”, official sources said. The unions also asked

for extending the benefit to workers under the Industrial Disputes Act,

they added.

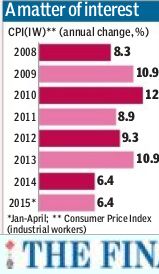

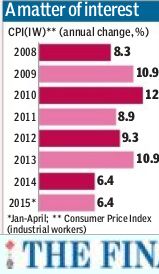

The revision of the bonus eligibility and the amounts is being done

by factoring in the relevant price increases, the gauge used being the

consumer price index-industrial workers or CPI(IW). This index stayed in

the range of 6.4-12% since 2008. After hitting as high as 12% in 2010,

CPI(IW) has maintained a roller-coaster ride — it eased to 8.9% in 2011

before rising to 10.9% in 2013 and dropping again to 6.4% in 2014. In

the current calendar year, it has slowed almost consistently from 7.2%

in January to 5.8% in April.

An

estimate is two-thirds of the 6 crore organised sector workforce in the

country are eligible for the mandatory bonus given their salary levels.

Analysts, however, say that actual number of beneficiaries could be

less as many units practically circumvent the norm.Under Section 10 of Payments of Bonus Act, “every employer (as

defined in the Act) shall be bound to pay to every employee in respect

of every accounting year, a minimum bonus which shall be 8.33% of the

salary or wage earned by the employee during the accounting year”. All

factories and establishments employing 20 or more persons are expected

to pay the bonus compulsorily, provided the worker has worked in the

establishment for at least 30 days. Employees in Life Insurance

Corporation, seamen, dock workers and university employees are outside

the Act’s ambit.

An

estimate is two-thirds of the 6 crore organised sector workforce in the

country are eligible for the mandatory bonus given their salary levels.

Analysts, however, say that actual number of beneficiaries could be

less as many units practically circumvent the norm.Under Section 10 of Payments of Bonus Act, “every employer (as

defined in the Act) shall be bound to pay to every employee in respect

of every accounting year, a minimum bonus which shall be 8.33% of the

salary or wage earned by the employee during the accounting year”. All

factories and establishments employing 20 or more persons are expected

to pay the bonus compulsorily, provided the worker has worked in the

establishment for at least 30 days. Employees in Life Insurance

Corporation, seamen, dock workers and university employees are outside

the Act’s ambit.

Although the country witnessed high inflation between 2009 and 2014,

the move to raise the bonus amounts comes at a time inflation has come

down (consumer price inflation is now below 5%). Consumer confidence is

yet to be restored to the pre-2008-09 levels, while in recent months

rural income growth has slowed.

Read at: Financial Express