Bank Employees Pay Scale as on May 2015 – Detailed Entry Level Salary for Clerk, Sub-staff, Officers

R-8/38 Raj Nagar

Ghaziabad (U.P.)

Ph. /Fax No: 0120-4136800 Mobile (G.S.): 9818562336

9818562336

E-mail: aipnbsf@yahoo.co.in Website: www.aipnbsf.org

Camp Office:

Punjab National Bank

Preet Vihar, Delhi-92

Circular No. 11/2015

10th BIPARTITE SETTLEMENT AT A GLANCE PAYSLIP INCREASE 15% (Rs.2270 CRORE)

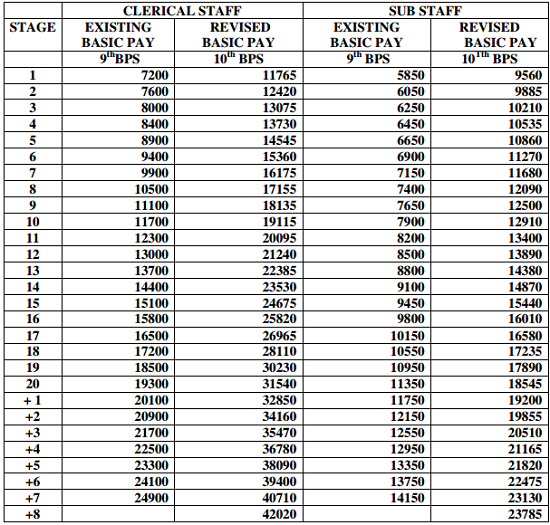

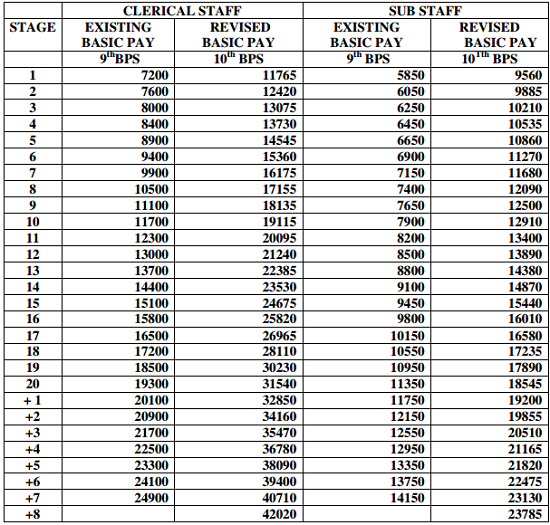

1. Pay Scales: With effect from 01.11.2012-

2. Stagnation Increments: 8 (Eight)

Sub-staff: 8×2 years;

Clerical: 5×3 years + 3×2 years

3. Dearness Allowance: 0.10% per slab of 4 points over 4440 points of CPI 1960 Base

4. PQP: Rs.410, 800, 1210, 1620, 2010

5. Special Pay: Clerical: SWO‘B’- 820, Head Cashier II- 1280, Special Assistant- 1930

Sub-staff: Armed Guard/Bills Collector- 390, Daftary- 560, Head Peon- 740

Driver- 2370, Electrician/AC Plant Helper- 2040, Head Messenger (IOB)- 1630

6. H.R.A.: Population 45 lacs & above- 10%, 12-45 lacs & Goa- 9%, Other Centres- 7.5%

7. FPP: Clerical: 1580, 1570, 1550/1450 (increment component- 1310)

Sub-Staff: 790, 780, 780/730 (Increment component- 655)

8. Transport Allowance: Upto 15th stage- Rs.425, 16th stage and above- Rs.470

9. Special Allowance (A New Allowance Introduced): 7.75% of Basic Pay + D.A. thereon

10. Medical Aid: Rs.2200 p.a.

11. Washing Allowance: Rs.150 p.m.

12. Cycle Allowance: Rs.100 p.m.

13. Dependent family Income Criteria: Income upto Rs 10,000 p.m.

The full Settlement is under preparation and will be signed on Monday, the 25th May, 2015. RBI has given its in principle clearance for implementing full holidays on 2nd & 4th Saturdays. Matter is being expedited with the Government now.

ALL INDIA PNB STAFF FEDERATION

(Affiliated to N.C.B.E.)

Central Office:(Affiliated to N.C.B.E.)

R-8/38 Raj Nagar

Ghaziabad (U.P.)

Ph. /Fax No: 0120-4136800 Mobile (G.S.):

E-mail: aipnbsf@yahoo.co.in Website: www.aipnbsf.org

Camp Office:

Punjab National Bank

Preet Vihar, Delhi-92

Circular No. 11/2015

Dated: 20.05.2015

TO ALL MEMBERS10th BIPARTITE SETTLEMENT AT A GLANCE PAYSLIP INCREASE 15% (Rs.2270 CRORE)

1. Pay Scales: With effect from 01.11.2012-

2. Stagnation Increments: 8 (Eight)

Sub-staff: 8×2 years;

Clerical: 5×3 years + 3×2 years

3. Dearness Allowance: 0.10% per slab of 4 points over 4440 points of CPI 1960 Base

4. PQP: Rs.410, 800, 1210, 1620, 2010

5. Special Pay: Clerical: SWO‘B’- 820, Head Cashier II- 1280, Special Assistant- 1930

Sub-staff: Armed Guard/Bills Collector- 390, Daftary- 560, Head Peon- 740

Driver- 2370, Electrician/AC Plant Helper- 2040, Head Messenger (IOB)- 1630

6. H.R.A.: Population 45 lacs & above- 10%, 12-45 lacs & Goa- 9%, Other Centres- 7.5%

7. FPP: Clerical: 1580, 1570, 1550/1450 (increment component- 1310)

Sub-Staff: 790, 780, 780/730 (Increment component- 655)

8. Transport Allowance: Upto 15th stage- Rs.425, 16th stage and above- Rs.470

9. Special Allowance (A New Allowance Introduced): 7.75% of Basic Pay + D.A. thereon

10. Medical Aid: Rs.2200 p.a.

11. Washing Allowance: Rs.150 p.m.

12. Cycle Allowance: Rs.100 p.m.

13. Dependent family Income Criteria: Income upto Rs 10,000 p.m.

The full Settlement is under preparation and will be signed on Monday, the 25th May, 2015. RBI has given its in principle clearance for implementing full holidays on 2nd & 4th Saturdays. Matter is being expedited with the Government now.

With Greetings,

Yours comradely,

(R.K.SHARMA)

GENERAL SECRETARY

Source: www.aipnbsf.orgYours comradely,

(R.K.SHARMA)

GENERAL SECRETARY